Tax due diligence (TDD) is the third most relevant DD stream alongside legal and financial, according to the EY 2023 EUW B&I Barometer. Developing tax structures, gauging tax optimization opportunities, and avoiding pitfalls are some of the most complicated tasks in the M&A lifecycle.

We have prepared a comprehensive guide with the checklist to help M&A buyers and investors navigate due diligence complexities. In this article, you will learn the following:

As a bonus, we’ll offer you technology considerations for effective tax due diligence. Without further ado, let’s dive in.

Conducting tax due diligence means thoroughly examining all tax aspects of the target company before a business transaction.

Acquiring companies and investors seek the following objectives with tax due diligence:

Tax due diligence may impact deal valuation in the following ways:

Let’s illustrate the asset valuation tax impact with the case study (fictional).

| Scenario: Company A acquires Company B for $100 million. |

| Tax DD findings |

| Company A finds that Company B has ambiguous R&D tax deductions during tax liability analysis. Supporting documentation has many inconsistencies, and its eligibility may be uncertain. Upon the transaction, the acquiring company risks inheriting an additional $10 million in target company’s tax liabilities. There is a 50% probability of penalties from the government. |

| Outcome |

| Company A decides to reduce the deal price by 75% of the potential $10-million tax liability ($7.5 million). During pre-closing negotiations, Company A reduces the final purchase price to $92.5 million to cover post-merger tax liabilities. |

The tax due diligence checklist should encompass many areas, from tax records and attributes to commitments and audits. The table below contains a sample checklist categorized by tax due diligence areas.

☐ Review of foreign financial accounts

☐ Fiscal documentation review

☐ Copies of federal, state, and local tax returns

☐ Tax payments

☐ Income tax records

☐ Payroll tax records

☐ VAT record

☐ Sales tax records

☐ Property tax records

☐ Human resources tax records

☐ Tax provisions in balance sheets, income statements, and cash flow statements

☐ Records of payments made to foreign recipients

☐ Tax warranties and representations

☐ Tax disclosure schedules

☐ Tax sharing agreements

☐ Uncertain tax positions

☐ Potential contingent tax liabilities

☐ Double taxation (foreign tax credit) issues

☐ Thin capitalization issues

☐ Controlled Foreign Corporations (CFC) issues

☐ Ring-fencing issues

☐ Deferred revenue records

☐ Issues in historical M&A tax strategies

☐ Historical ownership changes impacting tax attributes

☐ Tax reserves and provisions issues

☐ Source of income issues

☐ Classification issues of independent contractors

☐ Net operating losses (NOLs)

☐ Built-in losses

☐ Capital loss carryforwards

☐ Excess business loss limitations

☐ Tax incentives and credits

☐ R&D credit

☐ Child tax credit

☐ Alternative Minimum Tax (AMT) credits

☐ Foreign tax credits

☐ Documentation of tax basis in assets

☐ Tax-exempt interest income

☐ Tax depreciation opportunities

☐ State-specific tax attributes

☐ Overall audit readiness

☐ History of tax opinions and rulings

☐ Tax audit notices

☐ Tax audits with correspondence (past, ongoing, and pending)

☐ Internal audit reports

☐ Tax examination reports

☐ Settlement agreements

☐ Records of tax remediation efforts

☐ Jurisdiction of the target company operates in

☐ Target’s internal tax compliance policies and procedures

☐ Tax compliance certificates

☐ Compliance with federal income tax rules

☐ Transfer pricing documentation in applicable jurisdictions

☐ Past, ongoing, and upcoming tax litigations

☐ Data privacy and protection legalities

☐ Tax law changes that impact the target’s tax position

Based on our observations, DD checklists become more effective when combined with the following practices:

Acquirers have to consider the following data aspects during tax due diligence:

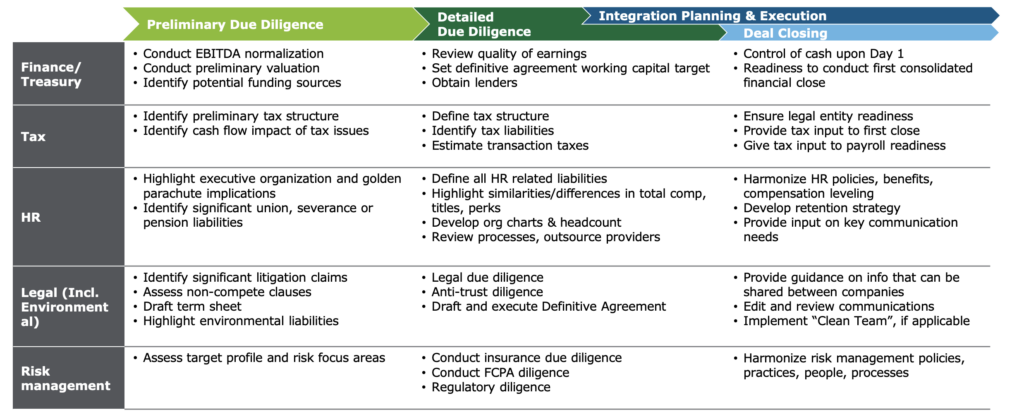

Experienced acquirers start investigating various aspects of the target company after signing a letter of intent. It’s the time when deal parties agree on the deal structure and sign warranties & representations and NDAs. Successful acquirers also initiate tax due diligence simultaneously with other functional DD areas for a 360-degree view of risks and opportunities.

“When business leaders ask me the ideal time to get the tax department involved in integration planning, I tell them ‘When you sign the letter of intent.’” Pam Beckey, partner, Deloitte Tax LLP and leader of its Post-Merger Integration practice.

Acquirers can focus on the following areas during tax due diligence alongside risk assessments:

Tax due diligence plays a crucial role in the increasingly complex regulatory environment and is integral to successful deals. According to Bain & Company’s 2023 M&A survey, nearly 40% of respondents indicated high-quality due diligence as the main success factor.

Meanwhile, over 60% of deals fail because of poor due diligence. Companies pursuing successful deals can leverage several tax due diligence strategies to minimize risks and improve integration outcomes.

Successful acquirers and the world’s best consulting firms recommend integrated due diligence as a holistic view of the target company’s risks and opportunities.

The integrated approach detects indirect tax considerations across diligence areas, such as financial statements, operations, and human resources. It provides more accurate information on the acquisition target than isolated, one-dimensional DD findings.

“Integrated due diligence is the only way to really understand how pulling a lever in one area of the business will affect assumptions in another.” Bain & Company.

The integrated approach to tax due diligence should cover the following aspects:

| 🔸 Check our operational due diligence framework to interconnect operational tax implications. |

Countries lose over $427 billion yearly due to tax abuse. Many companies rely on tax havens and sometimes deliberately evade taxation, especially in the real estate market.

Therefore, it’s crucial to thoroughly review the target company’s tax history. Records for the past several years will help you understand how your target complies with tax regulations. It will also help you spot several red flags indicating tax abuse.

| Red flag | Explanation |

| Frequent amendments in tax returns | Possible attempts to manipulate financial information |

| Inconsistent provisions in different tax records | Systematic inconsistencies may indicate deliberate attempts to hide money laundering activities |

| Unnecessarily complex corporate structure | Possible attempts to distract authorities, auditors, and corporate buyers from fraudulent activities |

| Consistent business losses | Possible attempts to evade taxes by offsetting taxable income |

| Tax filing delays | Possible attempts to hide money-laundering activities |

| Cash-intensive transactions | Over-reliance on cash transactions may indicate underreporting and tax evasion |

| Frequent changes in auditing services | Frequent changes in accounting and auditing services may indicate attempts to conceal tax reporting inconsistencies |

| 🔸 Check our real estate investment due diligence checklist to spot more taxation red flags in real estate targets. |

Tax due diligence may be much more complex than other types of due diligence. According to Financial Executives International, TDD may take up to 60 days.

Since nearly all due diligence areas carry specific tax implications and exposures, acquirers should rely on external vendors. As much as 60% of mergers and acquisitions involve third-party advisors, according to the M&A study on 100,544 U.S. acquisitions.

Professional services help develop the industry’s best due diligence requirements and identify many more issues, especially cross-border tax implications. Sell-side parties, especially startups, develop due diligence readiness checklists for smooth transactions as well. However, the study reveals it’s not advisable to hire more than one advisory service.

| 🔸 Discover nine components of the startup due diligence checklist for successful transactions. |

Digital capabilities have long been accelerating M&A activities. According to Accenture’s study, digital tools help acquirers unlock an additional $30 million in deal value and save up to three months on M&A activities, including due diligence. Thus, automated due diligence software, such as virtual data rooms (VDRs), ensures a holistic approach to target investigations and deliver the best outcomes with the following features:

Rely on our expert choice – iDeals VDR

Common tax due diligence issues are limited data availability, inconsistencies in tax records, and invalid tax information. Acquirers should carefully check targets for red flags, such as inconsistent records, overdue tax filings, and frequent amendments in tax records.

The tax return due diligence checklist should be continuously updated and revised during the due diligence process. Dealmakers frequently exchange checklists and update checklist items.

The tax due diligence checklist during acquisition should include tax records, commitments, attributes, exposures, liabilities, audits, and compliance documentation. TDD should be multidimensional and explore interdependencies with other DD streams.

Elisa is a marketing specialist with 15 years of experience. She worked for many VDR brands and gained insider knowledge of the industry.

At DataRooms.org, Elisa conducts marketing research, develops content plans, supervises content teams, and develops VDR review methodology. She envisions her mission as distributing accurate knowledge of virtual data rooms.

“My mission is to deliver accurate and relevant knowledge of virtual data rooms to as many people as possible.”